This is the new Series25 Knowledge Base where you’ll find all product help, exclusive customer resources, best practices, and training information.

Using This Knowledge Base

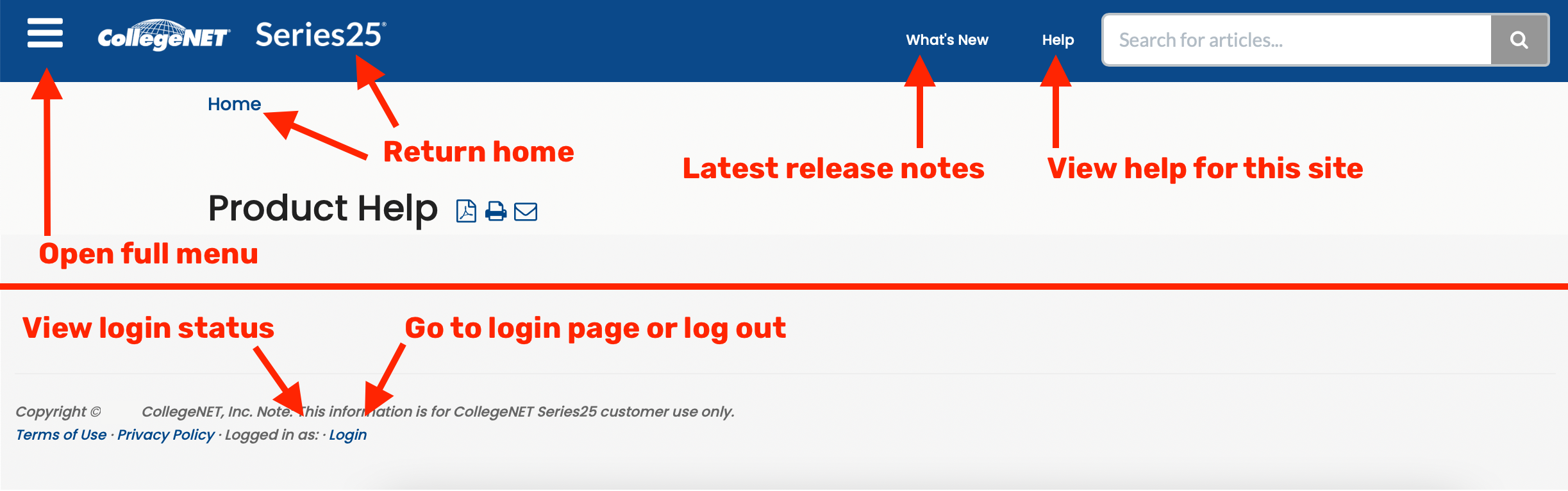

Image: Use the login link at the bottom of the page to access exclusive content.

Image: Use the login link at the bottom of the page to access exclusive content.

Viewing Series25 Product Help

Series25 Product Help pages don't require a login to view and are also accessible from your Series25 applications. Please use the search to find what you were looking for. In addition, you can browse lists of Product Help pages.

View all the latest release notes on the What's New in Series25 page.

Logging In to Customer Resources

Content that is exclusively available to Series25 customers requires a login to view. Use the Login link at the very bottom of the page. If you've reached an access warning page, enter the username and password then go back to your original link.

Contact Us

If you need additional help or don't know your customer login, please contact support.